LIFE INSURANCE

Protection for You and Your Family

Life insurance is one of the cornerstones of good financial planning. It protects your loved ones against financial loss in the event of your death. Life insurance provides access to many resources provided by MetLife through Geneva Benefits Group.

Benefits of Basic Life Insurance

• Protect the ones you love against financial loss in the event of your death

• Replace lost income and lessen the impact of costs associated with serious injuries, including medical bills, in the event of death due to an accident

• Use your insurance benefit to pay off debt or funeral costs, create an educational fund for your children, or even provide long-term care for a family member with special needs

Term Life Insurance Plans

Geneva offers four additional life insurance plans that can be added to our basic plan. Click on each link to explore.

In Partnership With

How Much Insurance Do You Need?

According to the nonprofit Life and Health Insurance Foundation for Education, the answer isn’t how much life insurance you need, but how much money your family will need after you’re gone.

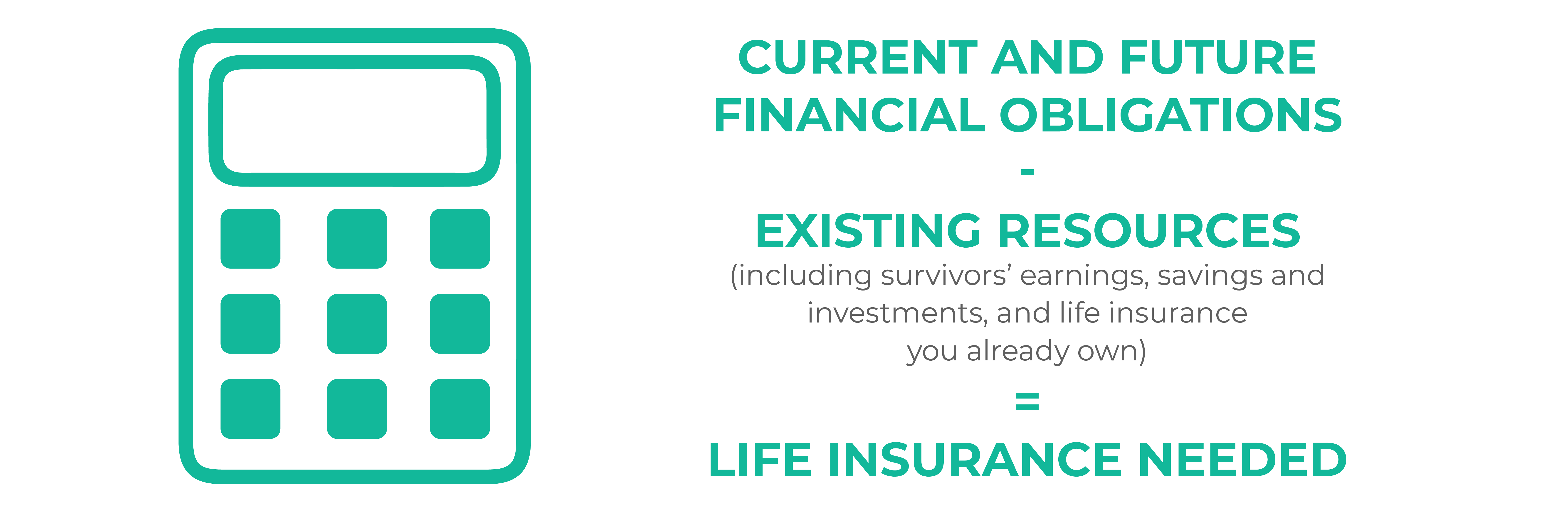

One simple way to start is by using the equation below. The amount of life insurance you need equals your current and future financial obligations minus your existing resources.

Benefit Amounts for Basic Life Insurance

• $25,000 for most active employees, $5,000 retired PCA Teaching Elders (without AD&D)

• If there is a death or defined loss due to an accident, your beneficiaries will receive an equal AD&D benefit in addition to the Basic Life Insurance benefit

Who Can Participate?

• Full-time (minimum 30 hours per week) employee of PCA church or like-minded organization, living in the U.S.

• Enrollment in the Geneva Basic Life and AD&D Plan is a prerequisite to enrollment in any other Geneva Life or AD&D Plans

Get Started

Connect with a Geneva team member to learn more

FAQ

How much life insurance do I need?

You need enough coverage to meet the needs of your survivors and should consider expenses such as a mortgage, raising children, and college. A general rule of thumb is to start with 10 times your annual income. Remember, the amount you need is always changing. A 35-year-old with a spouse and kids needs far more life insurance than a couple nearing their 60’s who are empty nesters.

How do we add insurance benefits?

You can add insurance benefits for your church/ministry staff by following these simple steps:

Step 1: Visit our My Benefits page to download and complete two forms:

A) Group Insurance Adoption Agreement (IAA). This allows you to select which insurance products your organization will offer full-time employees.

B) Benefit Plan Enrollment Form. This provides us with the information needed to set up an account in SmartBen (our on-line benefits administrator).

Step 2: Request a secure email link by emailing us at enrollment@genevabenefits.org.

Step 3: Submit forms through secure link.

Do I have to fill out a medical questionnaire for insurance?

Most of our insurance products are designed to be offered without medical questions if you enroll within 30 days of your date of hire at your ministry organization.

Can I participate individually in insurance if my church does not?

No. Your ministry organization must agree to participate in one or more of the products offered by Geneva for you to participate in them.